Professional liability insurance protects business professionals from lawsuits that allege mistakes or negligence. Most people associate it with medical malpractice, but it covers a lot more than that.

Professional liability coverage is extremely important for professionals and businesses in the service or consulting industry, including attorneys, accountants, consultants, engineers, and other professions. Whether you’re a business owner or an employee, you might have questions about professional liability insurance — what it covers, how much it costs, and when you need it.

What Is Professional Liability Insurance?

Many professionals choose to buy professional liability insurance as a form of protection. This is the “I hope I never make a mistake that hurts someone else, but if I do, I don’t want it to financially destroy me or my business” type of insurance.

Professional liability insurance protects you in case of a lawsuit filed by a client over an alleged or actual mistake or a bad piece of advice. Where general liability insurance is designed to cover accidents that could happen in almost any setting (e.g., client slips and falls on your property), professional liability insurance is for something like you miscalculate medication dosage/financial figures/advice resulting in damage to a client.

It’s important to understand that professional liability insurance isn't just for business owners or medical professionals — employees and independent contractors in a variety of industries may also want it so they don’t have to worry about financial distress from a lawsuit.

Who Needs Professional Liability Insurance Coverage?

Professional liability insurance is often necessary because general liability insurance typically excludes claims of negligence, malpractice, or misrepresentation. “A person may need professional liability insurance if they have clients, because this type of insurance helps protect a person against claims like negligence, inaccurate service, and misrepresentation,” explains Ben Michael, attorney at Michael & Associates.

Business professionals typically need professional liability insurance when the risk of their mistake could cost a company, person, or family a lot of money, pain, or suffering. This means that every profession, from an architect to a dentist, could benefit from coverage. The protection can help offset the financial burden and stress a lawsuit could bring. Here’s a list of professions who often buy professional liability insurance:

- Accountants

- Allied health professionals

- Architects/Engineers

- Counselors

- Dental hygienists

- Dentists

- Financial or investment advisors

- Freelancers, including graphic designers, copywriters, and social media specialists

- Health and wellness professionals, including personal trainers

- Insurance agents and brokers

- Medical professionals

- Real estate agents and broker firms

- Social workers

- Technology experts

A professional liability policy is designed to protect you, the professional, from claims in the case of:

- Errors and omissions

- Medical malpractice or failure to meet a standard of care

- Board actions (typical in medical and dental malpractice cases)

According to Michael, “It is typically recommended for those who run their own businesses to get this kind of insurance, as well as for many freelancers.” Freelancers are in business for themselves and don’t have protection from an employer’s liability policy. Having their own coverage can insulate freelancers from the financial burden of a lawsuit.

Daniel J. Struck, partner and insurance practice chair at Culhane Meadows, agrees: “I have seen a surprising number of small and medium-sized companies discover they need insurance, because those companies provide technology, design, or other services that require a particular level of skill or expertise.” A mistake could cost their client a lot of money, and professional liability insurance can offer financial protection against claims and lawsuits.

Professional Liability Insurance Definition & Related Terms to Know

Before we dive into everything you need to know about professional liability insurance, here’s a mini glossary of words you might see used or see in a future policy.

Certificate of insurance (COI)

A COI is a document issued by the insurance company describing coverage and summarizing the most important details of a policy, including the effective dates. This document is most commonly used to confirm that insurance coverage meets requirements detailed between two parties involved in a binding agreement.

Claims-made policy

Claims-made policies cover incidents only if the claim is made against the insured and reported to the insurer during the policy period.

Learn more about claims-made policies vs. occurrence policies

Defense costs

These are attorneys’ fees and expenses, court filing fees, and money paid to expert witnesses. This is separate from the money that might be needed to pay the claimant/plaintiff for a settlement or court judgment.

Limits of liability:

Liability limits refer to the maximum amount the insurance company will cover on a case-by-case basis or over a given period of the policy. Limits of liability have two components: how much the policy will cover per claim (or per occurrence) and the maximum it will cover over a given period of time before a possible renewal (known as the aggregate limit). You also might hear limits of liability mentioned when discussing whether defense costs are “inside the limits” or “outside the limits” of the policy. If defense costs are inside the limits of liability, the money paid to the lawyers will reduce the amount available to pay a settlement or judgment.

Learn more about limits of liability

Occurrence policy:

Occurrence policies cover incidents that occur during the policy period, no matter when the claim is filed.

Supplemental policy:

Insurance coverage purchased in addition to an existing policy is a supplemental insurance policy. Professionals might buy this when their employer has a policy that covers all employees, but they are concerned the employer’s policy won’t give them enough coverage or control in decisions. Medical professionals might also buy supplemental coverage if they want protection in board actions, which employer policies often don’t assist with.

Tail coverage:

This type of coverage extends the coverage of a claims-made policy after the original policy ends. You would likely buy tail coverage if you were leaving a job and had a claims-made policy with that employer. Medical professionals may get free tail coverage if they are retiring and held a policy with the insurer for a specific amount of time.

Learn more about tail insurance

What Does Professional Liability Insurance Cover?

Professional liability insurance can provide you with an attorney, pay for your defense costs, and cover related settlement payments. “Professional liability insurance covers a variety of claims, including negligence, inaccurate or undelivered service, misrepresentation, copyright infringement, and personal injury (libel or slander),” says Michael.

What does this mean for you as a small business owner, independent contractor, or healthcare worker? You’ll have financial protection if you’re:

- Sued for making a mistake or overlooking a detail

- Named in a claim with teammates you work with, because you’re part of the same group

- Wrongly accused of events that lead to the bad outcome

All these scenarios need legal counsel and finances to assist in your defense.

What Doesn’t Professional Liability Insurance Cover?

While professional liability covers some key risks, it does not cover everything that might go wrong at your place of work. For example, professional liability insurance typically does not cover defense costs or liability for the following categories of claims:

- Discrimination

- Work-related injuries to employees

- The costs of responding to a data breach (a cyber policy can be added to a Berxi E&O policy)

- Criminal activity and intentional wrongdoing

- Property damage

- Injuries to a customer or client while on your property (like if they fall in your office)

What Should Be in a Professional Liability Insurance Policy?

For covered claims, professional liability insurance policies can shield you from the financial impact of defending a claim against you. Policies typically cover legal expenses such as:

- Attorneys’ fees

- Arbitration costs

- Expert testimony fees

- Court costs

- Cost of attending trials

- Settlement costs

- Judgment costs

- License protection (if the licensing authority investigates you)

- Wage loss

Professional liability insurance doesn’t cover everything. For example, it does not cover claims such as property damage, discrimination, or business claims.

In addition, according to Struck, “A recurring challenge for insureds is that the lines between what constitutes an error or omission triggering professional liability insurance and an accident that triggers general liability insurance are not always well defined.” He emphasizes the need for both professional liability and general liability to avoid a gap in coverage.

What’s the Difference Between Professional Liability Insurance & General Liability Insurance?

Professional liability and general liability insurance get mixed up all the time. Sometimes these can be purchased together, but often a small business owner will have to buy them separately. Here’s how these policies are different:

- General liability insurance covers costs if a customer is injured or suffers damage to personal property while doing business at your location. (Ex. Someone falls on your property or their belongings are ruined in a flood.)

- Professional liability insurance, also called errors and omissions insurance (E&O), handles claims that come from something you allegedly did wrong or neglected to do. (Ex. A bookkeeper mixes up some numbers; a home inspector misses a leaking roof; a contractor doesn’t fulfill all obligations.)

Types of Professional Liability Insurance

Many people associate professional liability insurance with errors and omissions (E&O) insurance, but it’s much more than that. Professional liability is a larger category that includes E&O, business liability (general liability), and medical and dental malpractice insurance.

Errors & Omissions Insurance

A professional liability policy with E&O coverage protects people who provide advice for a living. It generally protects you, your company, and your employees if a customer sues you for negligence, errors, misrepresentation, or mistakes.

For example, suppose an accountant at your firm offers advice to your client that leads to a large financial loss. Your client could sue your firm for negligence, and E&O insurance can help pay for defense costs and judgments or settlements relating to the claim

Learn more about E&O insurance

Business Liability

Business liability is a type of insurance that protects against bodily injury, property damage, and personal injury claims. Business insurance can provide indemnification and legal representation if you or your business is sued by a customer or client who has suffered bodily or personal and/or property damage due to an act perpetrated by you or someone in your company.

Medical Malpractice

Medical malpractice insurance is specific to healthcare professionals. It protects healthcare professionals and providers if they make a medical error that causes harm. You may be covered if you neglect to provide appropriate treatment, fail to take an appropriate action, or provide treatment to a patient that causes harm, injury, or death.

Dental Malpractice

Dental malpractice is a type of medical malpractice insurance for dental professionals. Examples of dental malpractice could include failure to diagnose oral or tongue cancer, root canal mistakes, improper administration of anesthesia, or errors or negligence when placing crowns, bridges, fillings, or dental implants.

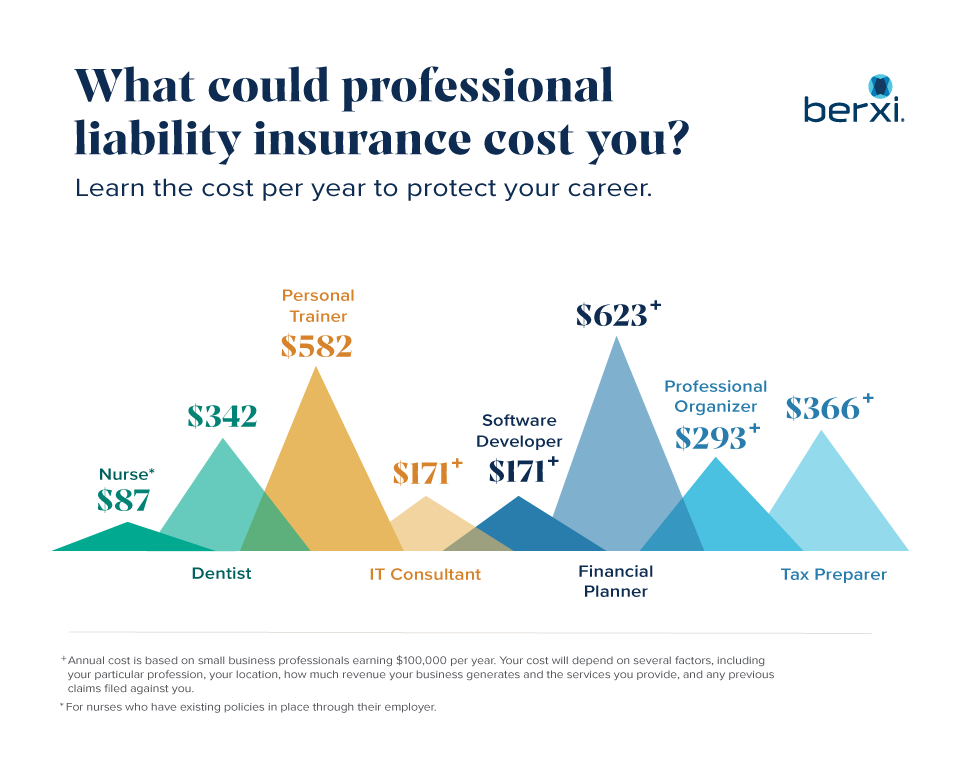

How Much Does Professional Liability Insurance Cost?

Professional liability insurance isn’t a one-size-fits-all proposition. The factors that influence cost may include the nature or size of your organization and the professional services you provide to clients. A policy for a dentist, for instance, will be vastly different from a policy for a yoga instructor.

The cost of professional liability insurance also varies due to location, policy limits, and additional coverage you may need, such as business or general liability coverage. Here are some starting figures for policies to help you get an idea of what you might pay for coverage. While the nurse policy is based on supplemental pricing, the other industries are based on primary insurance figures.

|

Profession |

Cost* |

|

$171+ per year |

|

|

$87 per year |

|

|

$342+ per year for a claims-made policy $1,123+ per year for an occurrence policy |

|

|

Financial Planner |

$623+ per year |

|

Personal Trainer |

$582+ per year |

|

Professional Organizer |

$293+ per year |

|

Software Developer |

$171+ per year |

|

Tax Preparer |

$366+ per year |

**Annual cost is based on industry pricing averages. Your cost will depend on several factors, including your particular profession, your location, how much revenue your business generates and the services you provide, and any previous claims filed against you. These prices are based on Texas professionals earning $100,000 per year.

What to Look For in a Professional Liability Insurance Provider

Before you purchase professional liability insurance, you should consider a few things. First, you will want to find out whether you’re insured under an employer, agency, or institutional policy (and what that coverage includes). This will inform whether your policy would be primary or supplemental coverage and what limits of liability you are comfortable with.

There are many insurance companies that offer professional liability insurance. When researching which one is right for you, you might want to start by reading the “About Us'' section of the insurance company’s website. You should also read through the insurance policy details or ask a sales agent for specifics, such as:

- Legal defense costs outside the limits of liability

- Flexible policy limits

- Low deductible amounts

- Consent-to-settle clause

- Payment plans and options

- Online access to manage your policy

- Coverage extensions for additional protection

- Financial strength ratings that prove the insurer’s ability to pay future claims (A++ ratings are ideal)

- Easy-to-reach customer support

Above all, you should find a reputable insurance company, compare prices, and understand coverage, caps, and exclusions in the policy you are considering.

What's in Berxi's Professional Liability Insurance Policy?

Here’s what you will find if you explore one of the three types of professional liability insurance policies at Berxi.

Medical Malpractice

Berxi’s Professional Protection – Healthcare is available in both occurrence and claims-made policies for a range of healthcare professions. Our medical malpractice policies include:

- Legal defense outside the limits

- Consent to settle

- $0 deductibles

- Flexible limits of liability options based on your needs

- Convenient payment plans

- Customizable tail coverage

- Consent to settle

- Worldwide coverage

- Good Samaritan coverage

- HIPAA violation defense

- Licensing board protection defense

- Wage loss/deposition expenses

- Reputation coverage

General liability and Medicare/Medicaid reimbursement can also be purchased a la cart. With a Berxi policy, you’ll get even more than what’s listed in coverage; we provide you with world-class customer service and expert claims support, all delivered with empathy at an affordable price.

Curious how we stack up? Compare Berxi's medical malpractice insurance with the competition.

Dental Malpractice

With no membership fees required, Berxi offers affordable claims-made and occurrence policies for dental professionals, dental students, and new grads. Our Professional Protection – Dental policy typically includes:

- Legal defense outside the limits

- Consent to settle

- $0 deductible

- Flexible insurance limits, up to $2M per claim/$4M aggregate

- Convenient payment plans for select policies

- Tail coverage options for customers with claims-made policies

- Worldwide coverage

- Good Samaritan coverage

- HIPAA violation defense

- Medical waste legal expense coverage

- First aid expenses

- Peer review committee coverage

- Board action and license protection defense

- Wage loss/deposition expenses

- Student, new grad, and first year discounts

- Dental interview coverage (optional)

- Billing errors and omissions (optional)

Backed by Berkshire Hathaway Specialty Insurance Company, Berxi provides more value with an A++ financial strength rating from AM Best, excellent customer service, and a claims team focused on empathy and respect.

See how our dental malpractice insurance stacks up: Compare Berxi to other dental malpractice providers.

Errors & Omissions

Berxi’s Professional Protection – Liability can give you a sense of confidence with the financial strength of an A++ (Superior) rating, our excellent customer service, and top-tier claims support, without additional broker fees. Some inclusions in a Berxi E&O claims-made policy consist of:

- Attorneys’ fees

- Arbitration costs

- Expert testimony fees

- Court costs

- Cost of attending trials

- Settlement and judgment costs

- License protection (if a licensing authority investigates you)

- Wage loss for some of the time you spend assisting counsel with your defense

If you’re a real estate professional, we’ve got you covered with a real estate E&O policy that includes specific protections like Fair Housing Act coverage and Failure to Disclose Pollutants coverage. Check out the Berxi difference and see how our E&O policy compares.

Red Flags to Look For Before Buying Professional Liability Insurance

When you're ready to shop for professional liability insurance, watch for red flags before you purchase a policy. Besides making sure the policy meets your business needs and covers the services you provide to your customers, check the strength of the underwriting company and its credit rating, both of which are important factors.

- Poor financial strength: Look to independent agencies such as AM Best to assess the strength of the underwriter. AM Best is the largest insurance-specific agency to offer independent ratings. Ratings of A++ to B++ show that an insurer maintains sufficient capital to meet claims against its policies. A low rating of C++ or below could indicate the company may default on its obligations and not be able to cover your claims.

- Unhappy customers: Sometimes insurance companies refuse to cover claims or have high deductibles. To find reviews of the company, head to social media comments or search online for what people might be saying about the customer service, fine print that caught them off guard, claims coverage, deductibles, etc.

- Phone loops: Go ahead and give the company a call. Do you get someone? Do you like their tone? Or are you sent to a robot and go down a rabbit hole of touch tone responses? Now imagine you just had a professional liability claim filed against you — would you like this experience then?

Final Thoughts

Anyone who owns a business or operates as an independent contractor or freelancer should consider professional liability insurance. However, shopping for a policy can be tricky. “I cannot overstate the importance of making sure that an insured’s services are properly defined and that gaps between professional liability insurance and general liability insurance are avoided,” advises Struck.

Take the time to learn more about the coverage and make an informed decision on whether it's right for your business. If it is, research carefully before purchasing a policy so you understand what the coverage includes, as well as any policy caps or exclusions.

Image courtesy of istock.com/JoyImage